Fast 30 Year Landlord Loans

We don't really care about your personal tax returns. We understand that most landlords write off expenses and may demonstrate a small or even loss on business returns. That's OK with us -- we base our decisions on the LTV and conservative cash flow of the collateral, not your W2, and no proof of employment is required.

RentalHomeFinancing.com, a Direct Portfolio Lender, provides competitive, fixed rate financing for bulk single family homes and apartment buildings that are for rent.

Nationwide Footprint

We are offering permanent financing for investors with at least 1 rental property in most areas of the country with our innovative new programs geared toward the entrepreneur/investor. We also service foreign investors.

We will review the cash flow of the property and ensure they put you into a profitable position and will cover the annual debt service of >1.2x. Our products are commercial loans based upon the cash flow of the property, not you personally.

No Tax Returns

We don't need your W2 or tax returns. Decisions are based on property cash flow and LTV, not personal income.

Nationwide Lending

Available in most areas of the country, including programs designed for foreign national investors.

Close in 2-3 Weeks

Expeditious closing process with minimal closing costs and streamlined underwriting guidelines.

NEW -- 30/30 Investment Loan Program

30 year fixed rates for 1 property at a time! Our innovative 30/30 program gives landlords access to long-term stability with competitive rates and flexible terms.

30/30 Program Highlights

Before You Sign Anywhere Else

Before you sign and send thousands of dollars away in hopes of obtaining a loan, give us a call to discuss your rental portfolio, goals, and opportunity. We OFTEN beat the overall structure of your current lender by offering more favorable loan docs, credit terms/conditions, and a much cleaner closing process. We guarantee it will not be a waste of time. Call us today... 1-888-375-7977

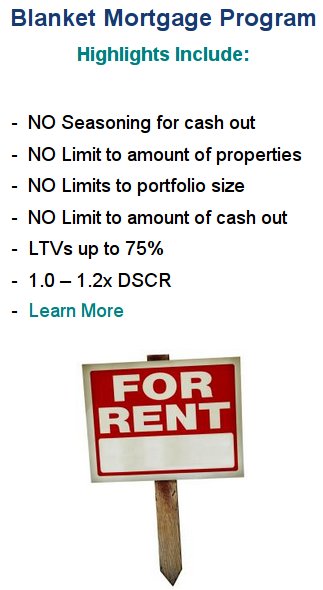

2nd Generation Securitization Blanket Loan

Our blanket loan programs offer 5, 10, and 30 year fixed rate options with 30 year amortization, designed for landlords building serious rental portfolios.

Blanket Loan Highlights: 5 - 10 - 30 Year

- No Seasoning For Value -- Buy A House Today, Finance For Value Tomorrow

- Loan Sizes $300K To $30 Million+

- Property Minimum Value $50-75K (Depends On MSA)

- 70-75% LTV / LTC Max

- Full Term I/O Available To 60-65%

- Purchase - Refinance - Cash Out (Unlimited)

- Non US Citizenship OK To 65%

- 620 Min FICO

Loan Doc Features -- Truly Unique Program That Will Save You Thousands

NO Yield Maintenance Pre-Payment Penalties (PPP)

NO Monthly CAPEX Reserve Requirements

NO Long Bond Forms

NO Fee Requirements For Lender's Attorney

NO Post-Closing Liquid Reserve Requirements

Recycle Existing LLC Is "OK"

Compatible with Your Current Investment Profile

- No Need To Form A New LLC Such As Delaware -- Use Your Existing One!

- Ability To Sell Or Release Properties At Any Time

- Ability To Use Your Title/Escrow Company -- Of Course Can Use Ours As Well, Your Choice!

- Far Easier Underwriting Guideline Model Than The Competition

- Expeditious Closing Process And Minimal Closing Costs

Property Types Available for 2nd Generation Blanket Loans

Single Family Housing

2 property minimum for blanket loan qualification. Perfect for landlords consolidating multiple SFR properties under one loan.

SFRs, Condos, Townhomes

Groups of single family rentals, condominiums, and townhomes can all be bundled into a single blanket loan structure.

Stated Multifamily

Searching for stated multifamily financing? We offer programs for apartment buildings and multi-unit properties.