What are blanket mortgages? When should they be used for financing income investment properties? What features and terms should real estate investors be demanding when shopping for a blanket mortgage loan?

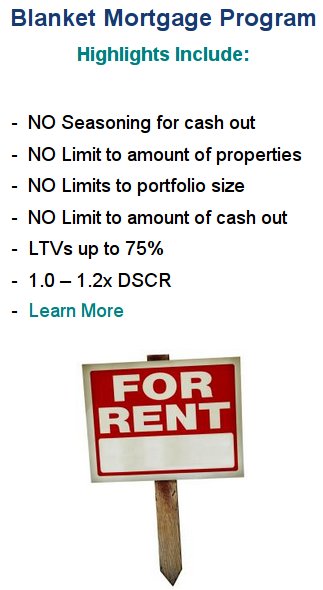

Blanket mortgages are used for funding more than one piece of property, in one loan, with a single servicer. Now, new Buy to Rent investor loans offer access to the benefits of blanket mortgages for refinancing and expanding single family rental home portfolios.

Blanket Mortgages 101

Blanket mortgages may be a new concept for many residential real estate investors. However, they have been used for decades by builders and developers, and commercial property investors. Blanket mortgages are used for funding more than one piece of property, in one loan, with a single servicer. Imagine if a builder or developer needed to arrange individual lot and home financing for every property in a new subdivision, or condominium building.

It would be a paperwork nightmare, not to mention slow, inefficient, and extremely expensive to the point of being cost prohibitive. Instead they obtain one mortgage loan which is secured by all of the property under a single loan. In the past this has been used as bridge or gap financing for those seeking to expand investment portfolios who may be equity rich, but cash poor. Or for offering increased security for a lender in exchange for better terms.

Multiple Properties, One Loan

Fund multiple investment properties under a single mortgage with one servicer, simplifying your portfolio management.

Access Captive Equity

Refinance to unlock equity trapped in your properties for improvements, holding costs, or new acquisitions.

Non-Recourse Options

Protect your personal assets with non-recourse loan structures designed for qualifying real estate investors.

When to Use a Blanket Mortgage

Blanket mortgages make a lot of sense for today's rental property investor. There are also many questions that investors are asking. Many income investors have poured much of their liquidity into making acquisitions, own property free and clear, but could use the additional flexibility of more cash on hand.

Those with 5 plus rental properties can use blanket mortgages to refinance, and access captive equity for making property improvements, covering holding costs, or simply taking advantage of low interest rates and leverage while recouping precious cash stores.

Others will want to use these investment property loans for making acquisitions while asset prices are attractive. Some of these buy to rent loans will allow for bulk buying of single family homes, or offer a credit facility for pooling property from different sources.

Why Now Is the Ideal Time for Blanket Mortgages

Whatever the purpose, this is an ideal time to use blanket mortgages for residential property investors. New Buy to Rent investor loans now offer access to the benefits of blanket mortgages for refinancing and expanding single family rental home portfolios. Whether you are equity rich and cash poor, or looking to make bulk acquisitions, a blanket mortgage can streamline your strategy.

What to Look for in a Blanket Mortgage Lender

When considering a blanket mortgage loan, there are several key factors that can make the difference between a good experience and a costly mistake. Here are 6 critical factors to evaluate:

6 Critical Factors for Choosing a Blanket Mortgage Lender

- A lender experienced at making blanket mortgage loans

- An investor friendly lender who actively wants to fund single family homes

- Non-recourse loans if at all possible

- Corporate or business entity loans and title holding for privacy and reduced liability

- If there are pre-payment penalties, and how much they are

- Longer amortization schedules for lower payments and more flexibility and cash flow

- Clarity on partial release clauses for selling individual units in the future

Ready to Explore Blanket Mortgage Options?

Speak with one of our qualified representatives today about financing your rental property portfolio.