The 5 year and 10 year SWAP index is commonly associated with CMBS. So how does it affect residential real estate investors and financing portfolios of single family rental homes?

Residential property investors taking advantage of new blanket mortgages for funding portfolios of rental homes will notice that their interest rates and total financing costs are directly linked to these indexes. If you are a rental investor, you should be looking into No DSCR Ratio Loans and our other blanket loan programs.

Swap Index Investor Concerns

Swap index rates are no longer useful for financing mortgage loans on investment property. They should only be used for residential properties, not investors. There are other options that can help you finance mortgage loans on investment property.

We have moved away from using swap index for loans because swapping the mortgage loans are not just expensive but they are also risky, due to the volatility in the swap market. When you use swap index rates for financing your mortgage, you are exposed to risks since there is no guarantee that they will decrease in the future.

No DSCR Ratio Loans

Based on rental income, not personal financials. No W-2s required and faster to close.

Blanket Loan Programs

Finance multiple rental properties under a single mortgage with predictable terms.

Apartment Building Loans

Investment loans that don't require you to wait on volatile swap index timing.

One of the most popular alternatives is No DSCR Ratio Loans. The DSCR ratio loans don't require an applicant's W-2 and are based on the amount of income a rental investment property will provide. No ratio loans are faster to close and do not require personal income verification. Instead, they help you build an investment business that can be quickly financed.

Commercial Mortgage Backed Securities and Your Loan

Commercial Mortgage Backed Securities (CMBS) are used to provide liquidity to finance markets, including the new breed of bulk single family rental property loans that was born in early 2014.

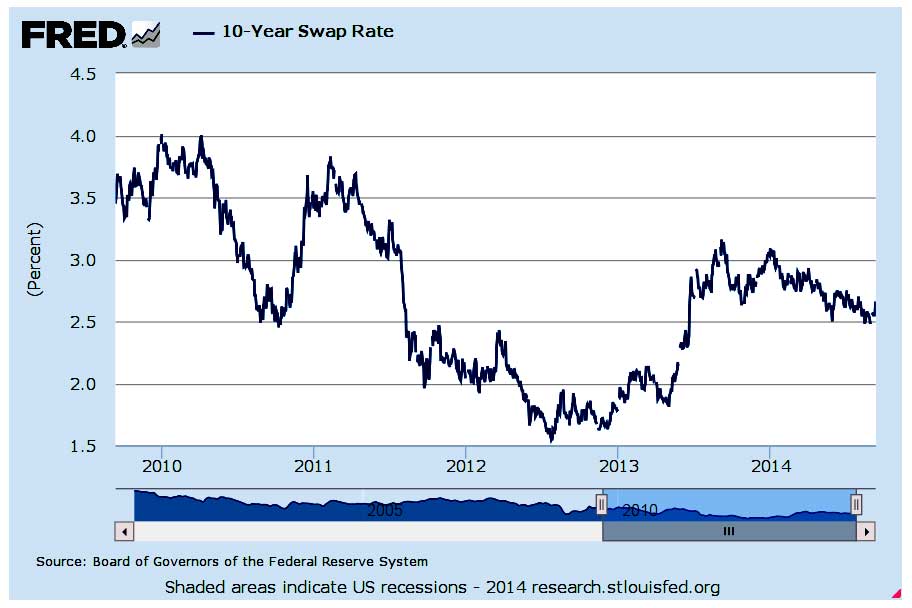

As these indexes are constantly floating it is more accurate for rates to be quoted in relation to these indexes. This also eliminates any frustration should indexes shift between initial application and closing the loan. For example, on Thursday, March 10th, 2016 the 10 year swap rate was at .71% according to FRED (Federal Reserve Economic Data). A loan with a 4.79% spread would give the borrower an effective rate of 4.375%.

Today's 5 & 10 Year SWAP Index

Latest 5 Year Swap Rate

Latest 10 Year Swap Rate

Source: FRED (Federal Reserve Economic Data)

Volatility in Swap Index Loans

These calculations are used to determine Debt Service Coverage (DSC) in underwriting. Swap rates also come into play for calculating prepayment penalties. Yield Maintenance or Defeasance prepayment penalties help ensure the lender is able to deliver on their promised returns to their investors.

Depending on when loans are refinanced or paid off, using the Swap Index formula can be quite risky; you can't control the volatility of the index. This can be detrimental in upfront estimates, underwriting mortgage loans, final interest rates, and negotiating and determining prepayment penalties.

Better Loans for Real Investors

As of the second quarter 2020, both five and ten year swap rates had been trending less optimal for investors. Those looking for vacation rental property loans and other blanket loan programs want our faster loans that don't require W-2s.

Our Loan Programs for Investors

- No DSCR Ratio Loans — no W-2, based on rental income

- Blanket Loans — one mortgage covering multiple properties

- Apartment Building Loans — multifamily investment financing

- All Loan Programs — explore our full range of investor products

Research analysts provide ongoing commentary on the CMBS market, which along with historical data can provide some insight into where rates are going and when the best times to secure new funding or refinance may be. Investors don't want to be told when they can invest or move their money. That is where our loan programs can help — our vacation rental property investment loans, blanket loans, and other products like our apartment building investment loans do not require you to wait like you would for a swap index loan.